Aditum Capital

Established 2023

Overview

Aditum Capital is an investment institution regulated by the Saudi Arabia Capital Market Authority (“CMA”) to provide Advising Services, and is 100% owned by Aditum Investment Management Limited, regulated by the DFSA.

The Team

The Senior Management Team has extensive experience in tailoring investment products and vehicles for regional clients and are well versed, across jurisdictions, in fund structure set up, operations and management and governance with clearly defined investment objectives and policies.

-

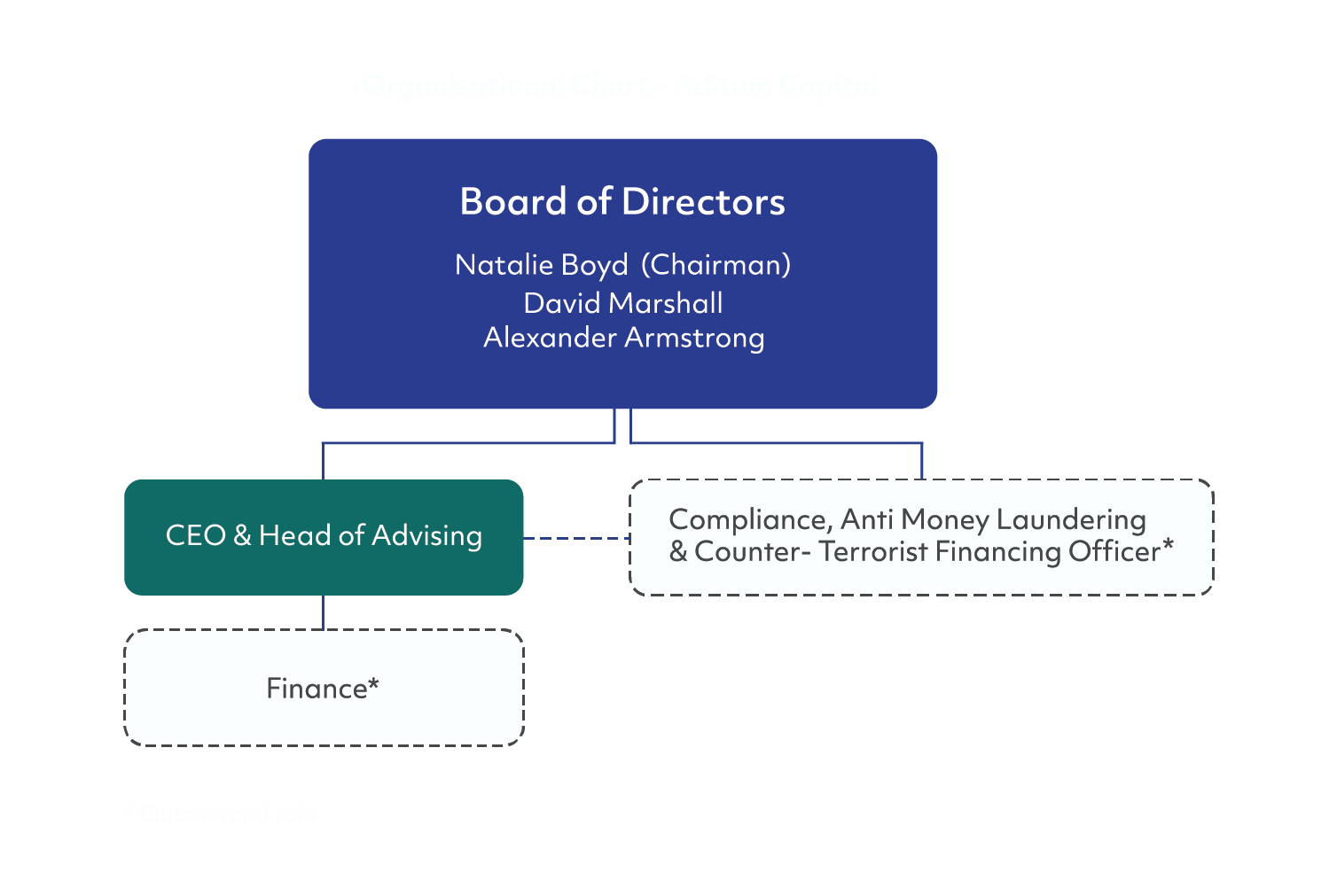

Board of Directors

-

Natalie Boyd

Chairman

Natalie Boyd is a highly experienced Finance and Investment Management lawyer with more than two decades of expertise in conventional and Islamic capital markets, structured financings and hedging products, Middle Eastern investment solutions and Middle Eastern financial services regulations. Ms. Boyd has extensive UK, European and Middle Eastern experience, having advised global institutional clients for over two decades on complex, often ground-breaking products and structures.

Mohammed Abalkhail

Board Member, Chief Executive Officer

Mr. Abalkhail joined Aditum Capital in July 2024 as Chief Executive Officer and Head of Advising. In this role, he leads the firm’s strategic direction and client advisory services.

Before joining Aditum Capital, Mr. Abalkhail was the Managing Director at Crédit Agricole Corporate & Investment Bank, where he was responsible for expanding the bank’s corporate and investment banking franchise in Saudi Arabia. Prior to this, he served as Advisor and Chief Investment Officer at the Ministry of Defence, Executive Affairs, collaborating closely with His Excellency, Deputy Minister of Defence on asset optimisation and private opportunities for the ministry.

Earlier in his career, Mr. Abalkhail held senior positions as Head of Investment Banking at both Alistithmar Capital and at Albilad Capital. He also served as VP in Product Development at Saudi Fransi Capital.

With over 20 years of industry experience in investment banking, Mr. Abalkhail’s expertise span across IPOs, M&A, private equity, real estate, and asset management. Throughout his career, he has played a key role in closing deals valued at SAR 64.63 billion (USD 17.23 billion).

Mr. Abalkhail holds an MBA from London Business School and a Bachelor of Mechanical Engineering with a Minor in Mathematics from the University of Missouri-Columbia.

Lucy Donnelly

Independent Member

Ms. Donnelly started her career at the leading global law firm Linklaters and has over 20 years of legal leadership experience advising at C-suite, executive, and board level for a number of listed and regulated blue-chip companies and multinationals including Credit Suisse, Visa and Emirates.

As a qualified General Counsel, Ms. Donnelly’s extensive experience includes government and sovereign wealth funds, regulated industry sectors such as banking and payments, and spans multiple geographies, including London, Dubai, Paris and Tokyo.

Ms. Donnelly is currently Director of Legal at DMCC (Dubai Multi Commodities Centre), a world leading business district and authority on international commodities trade and enterprise. Ms. Donnelly joined DMCC in 2019, where she oversees and is responsible for DMCC’s entire legal infrastructure.

Tariq Bin Hendi

Independent Member

Dr. Tariq Bin Hendi is a Senior Partner at Global Ventures and is the Chairman of Edelman Middle East, whilst also sitting on a number of boards, including UAE University, Gulf Capital, and 7X (formerly Emirates Post Group).

Prior to Global Ventures, Dr. Bin Hendi served as the Chief Investment Officer at G42 and as the Director General of the Abu Dhabi Investment Office Dr. Bin Hendi has held leadership and other roles at various institutions, including Emirates NBD, Mubadala, Dubai Holding, and Citibank.

Dr. Bin Hendi holds a PhD in Economics from the Imperial College London, graduate (MBA’s) degrees from Columbia University and London Business School and has an undergraduate degree in business administration and finance from Clayton State University. Dr. Bin Hendi is also a member of Young Presidents’ Organization (YPO) -

Management Team

-

Mohammed Abalkhail

Board Member, Chief Executive Officer

Mr. Abalkhail joined Aditum Capital in July 2024 as Chief Executive Officer and Head of Advising. In this role, he leads the firm’s strategic direction and client advisory services.

Before joining Aditum Capital, Mr. Abalkhail was the Managing Director at Crédit Agricole Corporate & Investment Bank, where he was responsible for expanding the bank’s corporate and investment banking franchise in Saudi Arabia. Prior to this, he served as Advisor and Chief Investment Officer at the Ministry of Defence, Executive Affairs, collaborating closely with His Excellency, Deputy Minister of Defence on asset optimisation and private opportunities for the ministry.

Earlier in his career, Mr. Abalkhail held senior positions as Head of Investment Banking at both Alistithmar Capital and at Albilad Capital. He also served as VP in Product Development at Saudi Fransi Capital.

With over 20 years of industry experience in investment banking, Mr. Abalkhail’s expertise span across IPOs, M&A, private equity, real estate, and asset management. Throughout his career, he has played a key role in closing deals valued at SAR 64.63 billion (USD 17.23 billion).

Mr. Abalkhail holds an MBA from London Business School and a Bachelor of Mechanical Engineering with a Minor in Mathematics from the University of Missouri-Columbia.

Bader Almoghirah

Compliance AML & CTF Manager

Mr. Almoghirah holds a Bachelor’s Degree in Business Administration with a specialisation in Finance from King Saud University, KSA. He has extensive experience in Compliance and Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF), having worked at one of the largest Capital Market Institutions licensed by the Capital Market Authority (CMA). Mr. Almoghirah joined Aditum Capital as Compliance AML & CTF Manager in September 2024.

Mr. Almoghirah previously serving as a Senior Officer for Compliance AML & CTF at Osool & Bakeet Investment Company. He has been instrumental in establishing and overseeing investment funds. He played a pivotal role in securing CMA and Tadawul approvals, making his previous institution the first Capital Market Institution listed in the Saudi Capital Market. His unwavering commitment to strengthening the compliance framework of his organisations has been central to his professional achievements.

Mr. Almoghirah holds multiple certifications, including the General Securities Qualification Certificate (CME1) and Compliance, Anti-Money Laundering & Counter-Terrorist Financing (CME2) and Certified Compliance Officer (CCO) and others. Additionally, he has completed professional training programs in the United States and the United Kingdom, further refining his expertise in the compliance field.

Mohammed Ansaf Salaldeen

Finance Manager

Mr. Salaldeen is a seasoned finance professional with over 13 years of experience spanning banking, retail, wholesale, real estate, and hospitality sectors. He currently serves as the Finance Manager at Aditum Capital, a role he assumed in April 2025.

He holds a master’s degree in finance from the University of Bedfordshire (UK) and a bachelor’s degree in accounting and finance from Rajarata University of Sri Lanka. Prior to joining Aditum Capital, he was the Accounting Manager at Unified Hospitality Company, where he played a key role in streamlining financial operations and supporting executive decision-making.

Mr. Salaldeen is highly skilled in financial reporting, management accounting, auditing, inventory control, fixed asset management, and HR operations. He has a proven track record of delivering results and driving financial efficiency.

He also holds multiple professional certifications, including the Association of Accounting Technicians of Sri Lanka, the Intermediate Level from the Institute of Chartered Accountants of Sri Lanka, as well as International Introduction to Securities and Investment Award (CME-1A), and has been awarded the Saudi Capital Market Rules and Regulations (General Chapter) (CME-1B).

Mohammed Aljohani

Head of Asset Management

Mr. Aljohani joined Aditum Capital in June 2024 as Head of Asset Management. He brings over 12 years of experience in the financial industry, with a focus on asset management and fixed income. In his previous roles, he has managed endowments and multi-asset funds at Alinma Investment Company and served as a Fixed Income Senior Specialist at the Real Estate Development Fund. Mr. Aljohani has also gained extensive experience at Samba Financial Group, where he held various treasury roles, including FX Sales and Fixed Income Management.

Mr. Aljohani holds a MSc in Finance from King Saud University and a BSc with a double major in Risk Management and Insurance, as well as Financial Planning and Investment, from Ball State University, U.S.

Mr. Aljohani is a Certified Treasury Manager (CTM) and has successfully passed Level II of the CFA Program.

Natalie Boyd

Chairman

Natalie Boyd is a highly experienced Finance and Investment Management lawyer with more than two decades of expertise in conventional and Islamic capital markets, structured financings and hedging products, Middle Eastern investment solutions and Middle Eastern financial services regulations. Ms. Boyd has extensive UK, European and Middle Eastern experience, having advised global institutional clients for over two decades on complex, often ground-breaking products and structures.

Mohammed Abalkhail

Board Member, Chief Executive Officer

Mr. Abalkhail joined Aditum Capital in July 2024 as Chief Executive Officer and Head of Advising. In this role, he leads the firm’s strategic direction and client advisory services.

Before joining Aditum Capital, Mr. Abalkhail was the Managing Director at Crédit Agricole Corporate & Investment Bank, where he was responsible for expanding the bank’s corporate and investment banking franchise in Saudi Arabia. Prior to this, he served as Advisor and Chief Investment Officer at the Ministry of Defence, Executive Affairs, collaborating closely with His Excellency, Deputy Minister of Defence on asset optimisation and private opportunities for the ministry.

Earlier in his career, Mr. Abalkhail held senior positions as Head of Investment Banking at both Alistithmar Capital and at Albilad Capital. He also served as VP in Product Development at Saudi Fransi Capital.

With over 20 years of industry experience in investment banking, Mr. Abalkhail’s expertise span across IPOs, M&A, private equity, real estate, and asset management. Throughout his career, he has played a key role in closing deals valued at SAR 64.63 billion (USD 17.23 billion).

Mr. Abalkhail holds an MBA from London Business School and a Bachelor of Mechanical Engineering with a Minor in Mathematics from the University of Missouri-Columbia.

Lucy Donnelly

Independent Member

Ms. Donnelly started her career at the leading global law firm Linklaters and has over 20 years of legal leadership experience advising at C-suite, executive, and board level for a number of listed and regulated blue-chip companies and multinationals including Credit Suisse, Visa and Emirates.

As a qualified General Counsel, Ms. Donnelly’s extensive experience includes government and sovereign wealth funds, regulated industry sectors such as banking and payments, and spans multiple geographies, including London, Dubai, Paris and Tokyo.

Ms. Donnelly is currently Director of Legal at DMCC (Dubai Multi Commodities Centre), a world leading business district and authority on international commodities trade and enterprise. Ms. Donnelly joined DMCC in 2019, where she oversees and is responsible for DMCC’s entire legal infrastructure.

Tariq Bin Hendi

Independent Member

Dr. Tariq Bin Hendi is a Senior Partner at Global Ventures and is the Chairman of Edelman Middle East, whilst also sitting on a number of boards, including UAE University, Gulf Capital, and 7X (formerly Emirates Post Group).

Prior to Global Ventures, Dr. Bin Hendi served as the Chief Investment Officer at G42 and as the Director General of the Abu Dhabi Investment Office Dr. Bin Hendi has held leadership and other roles at various institutions, including Emirates NBD, Mubadala, Dubai Holding, and Citibank.

Dr. Bin Hendi holds a PhD in Economics from the Imperial College London, graduate (MBA’s) degrees from Columbia University and London Business School and has an undergraduate degree in business administration and finance from Clayton State University. Dr. Bin Hendi is also a member of Young Presidents’ Organization (YPO)

Mohammed Abalkhail

Board Member, Chief Executive Officer

Mr. Abalkhail joined Aditum Capital in July 2024 as Chief Executive Officer and Head of Advising. In this role, he leads the firm’s strategic direction and client advisory services.

Before joining Aditum Capital, Mr. Abalkhail was the Managing Director at Crédit Agricole Corporate & Investment Bank, where he was responsible for expanding the bank’s corporate and investment banking franchise in Saudi Arabia. Prior to this, he served as Advisor and Chief Investment Officer at the Ministry of Defence, Executive Affairs, collaborating closely with His Excellency, Deputy Minister of Defence on asset optimisation and private opportunities for the ministry.

Earlier in his career, Mr. Abalkhail held senior positions as Head of Investment Banking at both Alistithmar Capital and at Albilad Capital. He also served as VP in Product Development at Saudi Fransi Capital.

With over 20 years of industry experience in investment banking, Mr. Abalkhail’s expertise span across IPOs, M&A, private equity, real estate, and asset management. Throughout his career, he has played a key role in closing deals valued at SAR 64.63 billion (USD 17.23 billion).

Mr. Abalkhail holds an MBA from London Business School and a Bachelor of Mechanical Engineering with a Minor in Mathematics from the University of Missouri-Columbia.

Bader Almoghirah

Compliance AML & CTF Manager

Mr. Almoghirah holds a Bachelor’s Degree in Business Administration with a specialisation in Finance from King Saud University, KSA. He has extensive experience in Compliance and Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF), having worked at one of the largest Capital Market Institutions licensed by the Capital Market Authority (CMA). Mr. Almoghirah joined Aditum Capital as Compliance AML & CTF Manager in September 2024.

Mr. Almoghirah previously serving as a Senior Officer for Compliance AML & CTF at Osool & Bakeet Investment Company. He has been instrumental in establishing and overseeing investment funds. He played a pivotal role in securing CMA and Tadawul approvals, making his previous institution the first Capital Market Institution listed in the Saudi Capital Market. His unwavering commitment to strengthening the compliance framework of his organisations has been central to his professional achievements.

Mr. Almoghirah holds multiple certifications, including the General Securities Qualification Certificate (CME1) and Compliance, Anti-Money Laundering & Counter-Terrorist Financing (CME2) and Certified Compliance Officer (CCO) and others. Additionally, he has completed professional training programs in the United States and the United Kingdom, further refining his expertise in the compliance field.

Mohammed Ansaf Salaldeen

Finance Manager

Mr. Salaldeen is a seasoned finance professional with over 13 years of experience spanning banking, retail, wholesale, real estate, and hospitality sectors. He currently serves as the Finance Manager at Aditum Capital, a role he assumed in April 2025.

He holds a master’s degree in finance from the University of Bedfordshire (UK) and a bachelor’s degree in accounting and finance from Rajarata University of Sri Lanka. Prior to joining Aditum Capital, he was the Accounting Manager at Unified Hospitality Company, where he played a key role in streamlining financial operations and supporting executive decision-making.

Mr. Salaldeen is highly skilled in financial reporting, management accounting, auditing, inventory control, fixed asset management, and HR operations. He has a proven track record of delivering results and driving financial efficiency.

He also holds multiple professional certifications, including the Association of Accounting Technicians of Sri Lanka, the Intermediate Level from the Institute of Chartered Accountants of Sri Lanka, as well as International Introduction to Securities and Investment Award (CME-1A), and has been awarded the Saudi Capital Market Rules and Regulations (General Chapter) (CME-1B).

Mohammed Aljohani

Head of Asset Management

Mr. Aljohani joined Aditum Capital in June 2024 as Head of Asset Management. He brings over 12 years of experience in the financial industry, with a focus on asset management and fixed income. In his previous roles, he has managed endowments and multi-asset funds at Alinma Investment Company and served as a Fixed Income Senior Specialist at the Real Estate Development Fund. Mr. Aljohani has also gained extensive experience at Samba Financial Group, where he held various treasury roles, including FX Sales and Fixed Income Management.

Mr. Aljohani holds a MSc in Finance from King Saud University and a BSc with a double major in Risk Management and Insurance, as well as Financial Planning and Investment, from Ball State University, U.S.

Mr. Aljohani is a Certified Treasury Manager (CTM) and has successfully passed Level II of the CFA Program.

Our Services

Established in 2023, Aditum Capital (“AKSA or “Aditum”) offers a wide range of advisory services across multiple jurisdictions, in both developed and emerging markets. Aditum’s services span across all asset classes, such as structuring investment funds and portfolios, including alternative investments, shares, debt instruments, warrants, certificates, units, options, futures, contracts for differences, long term insurance contract, Islamic investments, and Islamic structuring services. These services are integrated within the firm’s core functions, ensuring clients receive tailored advice aligned with their investment objectives and risk parameters. Aditum registered persons can offer advice on various forms of securities including managed and non-discretionary portfolios, mutual funds and fixed income instruments. In all cases, the advice will be restricted to permitted securities as per the Authority regulations.

Aditum provides advisory services to Qualified and Institutional clients only.

Aditum is a not a member of any exchanges, clearing centers or depositaries. However, it may advise clients in making investments and securities that have been listed on the markets and exchanges referenced below.

GCC

Saudi Exchange

Abu Dhabi Securities exchange

Bahrain Bourse

Qatar Stock Exchange

Dubai Financial Market

Kuwait Stock Exchange

Muscat Securities Market

Global

LSE

GEM – Irish Stock Exchange

Luxembourg Stock Exchange

Cayman Stock Exchange

New York Stock Exchange

Please reach out to us and we’ll be in touch with you shortly.

Address

5th Floor, Office #3,

Samama Tower,

King Fahad Road,

Olaya District,

Riyadh, Saudi Arabia

E-mail Address

For complaints

Email: info@aditum-capital.com